The Bowdoin College endowment, of which approximately 46 percent is restricted to the support of student financial aid, generated an investment return of 14.4 percent for the fiscal year that ended June 30, 2015.

The Bowdoin investment return of 14.4 percent compares with the mean return of 1.8 percent for all college and university endowments as reported by Cambridge Associates, a firm that tracks the performance of foundations and endowments nationwide.

According to Cambridge Associates, Bowdoin’s fiscal year return is once again in the top five percent of peer returns, defined as those endowments generating an investment return for the period of greater than 5.9 percent.

“This investment performance is truly remarkable,” said Bowdoin President Clayton Rose. “It represents outstanding work by Paula Volent, our senior vice president for investments, and her staff, and by an investment committee made up of brilliant professionals who care deeply about our College and understand the importance of building and stewarding these resources. A strong endowment is critical in our ability to deliver academic and residential life programs of the highest quality to every student—regardless of their economic circumstances—and to maintain excellence in all aspects of the College.”

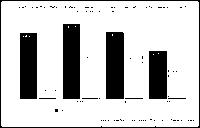

As of June 30, 2015, the three-, five-, and ten-year annualized returns for Bowdoin’s endowment were 16.5 percent, 14.7 percent and 10.5 percent, respectively—all top fifth percentile among comparative college and university annualized returns where the respective mean returns were 9.9 percent, 9.6 percent, and 6.6 percent.

On June 30, 2015, Bowdoin’s endowment was valued at $1.393 billion. During the fiscal year, the College received approximately $49.2 million in endowment gifts and transfers, and provided $45.2 million to the annual operations of the College. Of this, approximately $20.4 million supported financial aid. Admission to Bowdoin is “need-blind,” which means students are admitted without regard to their economic need. In 2008 the College adopted a “no-loan” policy, replacing student loans with grants.

Bowdoin’s endowment consists of more than 1,600 individual funds earmarked for the perpetual support of a variety of College initiatives. The endowment portfolio is diversified across different asset classes including domestic and international equities, fixed income, private equity, real estate and absolute return strategies. All asset classes are invested through a selection of external investment managers or through market indices. The portfolio is structured with a long-term time horizon, with portfolio diversification and manager selection directed toward protecting endowment capital in challenging investment environments, while growing those assets during periods of economic stability and growth.